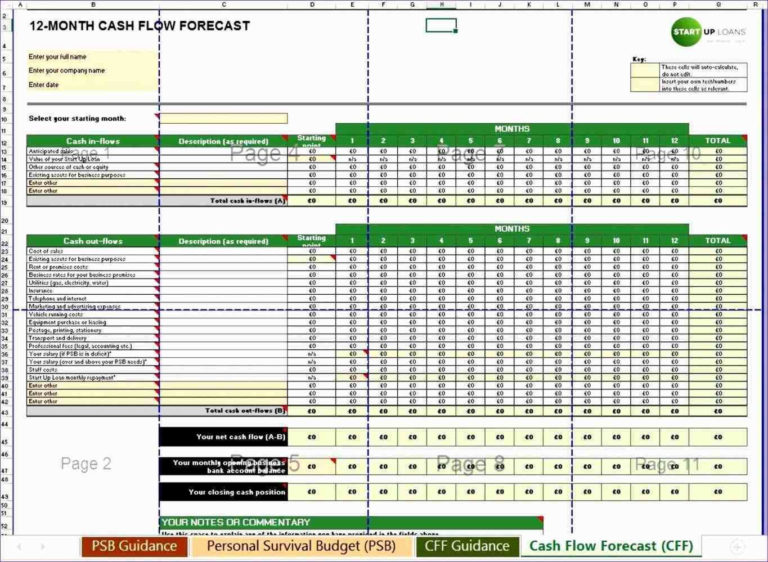

The 12 month cash flow forecast explained in financial accounting, a cash flow forecast - also known as a cash flow projection - provides businesses with a snapshot of their company’s future cash on hand. The primary benefit of using this template is that it helps you make better decisions about your business, whether that’s deciding which assets to purchase or which investments to make based on your existing cash flows. It allows you to see how much cash you will have in the future and how much debt you will have in the future. When you're just starting out with no revenue, forecasting seems like an unnecessary exercise - it's hard enough just trying to pay your bills each month! But as time goes by, your business will grow and change, and eventually those monthly expenses will become predictable patterns on your balance sheet instead of unpredictable surprises lurking around every corner.Ī cash flow projection is a key financial planning tool. But one thing that surprised me the most was how difficult it could be to forecast cash flow for 12 months at a time.

#Cash flow projection example how to

I didn't know what questions to ask or how to manage my finances responsibly. When I started my first business, a lot of things were new to me. But first, let’s look at the goal of a cash flow statement. Cash is the lifeblood of any business, and this article provides an in-depth overview of how to prepare, read, and analyze a 12 month cash flow statement template. This is one of the top reasons why small businesses and startups fail.

There’s one other thing that’s commonly overlooked, yet it is just as important as a balance sheet and an income statement.Īnd that’s running out of cash from improper cash flow management.

Although linked to one another, each one serves a unique purpose.

0 kommentar(er)

0 kommentar(er)